Rare earth market update on April 25, 2025

This week, the overall trend in domestic rare earth prices in China showed a widespread decline, primarily due to weak downstream demand, relatively abundant spot market supply, and heightened panic among suppliers. However, supported by strong production cost support and positive development in downstream rare earth industries, suppliers' willingness to offer discounts decreased toward the weekend.

According to CTIA GROUP LTD, this week's price changes include: praseodymium-neodymium oxide prices dropped by approximately 13,000 yuan/ton, a decline of 3.07%; praseodymium-neodymium metal prices fell by about 18,000 yuan/ton, a 3.44% decrease; terbium oxide prices decreased by around 450 yuan/kg, a 6.21% drop; dysprosium oxide prices declined by about 70,000 yuan/ton, a 4.14% reduction; 55N NdFeB blank prices fell by approximately 6 yuan/kg, a 2.87% decrease; and NdFeB scrap praseodymium-neodymium prices dropped by about 18 yuan/kg, a 4.03% decline. It is evident that prices for mainstream light and heavy rare earth products, as well as rare earth permanent magnet materials, saw significant declines this week, with terbium oxide experiencing the most notable drop, largely due to its significant prior price increase.

On the news front, data from the National Bureau of Statistics shows that in the first quarter, the production of "new three" products—new energy vehicles, lithium-ion batteries for vehicles, and solar cells—increased by 45.4%, 39.2%, and 18.5% year-on-year, respectively. Production of green products such as wind power generation units, carbon fiber and its composites, solid waste treatment equipment, and monocrystalline silicon rose by 74.4%, 45.6%, 14.9%, and 10.6%, respectively.

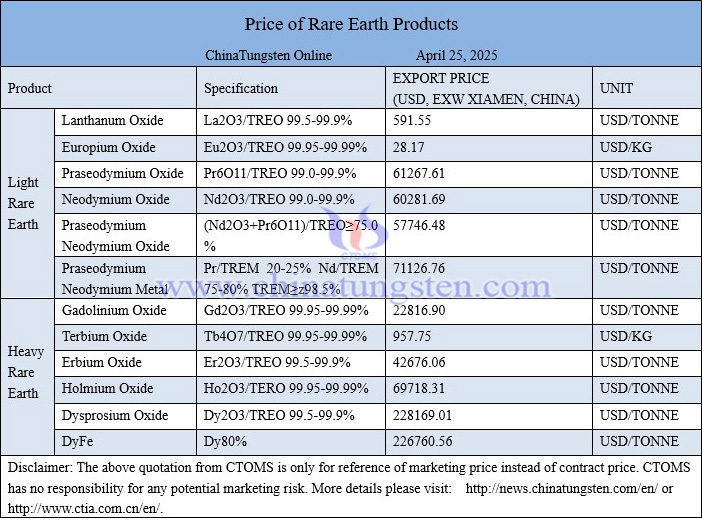

Price of rare earth products on April 25, 2025

Picture of erbium oxide