Rare earth market update on July 16, 2025

The domestic rare earth market is showing an overall sideways and volatile trend, influenced by multiple uncertainties. Transactions between buyers and sellers are primarily driven by essential demand, with product prices fluctuating within a reasonable range and transaction activity remaining moderate. In the light rare earth market, praseodymium-neodymium prices have experienced a pattern of rising and then falling back, mainly due to the recent significant increase in praseodymium-neodymium prices coupled with slow follow-through in downstream demand, leading to price corrections under pressure. In the medium and heavy rare earth market, the overall trend remains firm, with most suppliers maintaining relatively stable quotations, supported by downstream users’ essential procurement and strong price support from production costs.

Recently, several listed rare earth companies have successively released performance forecast announcements for the first half of 2025, which may bolster suppliers’ confidence in holding firm prices to some extent. Shenghe Resources expects to achieve a net profit attributable to shareholders of 305 million to 385 million yuan in the first half of 2025, an increase of 373.517 million to 453.517 million yuan compared to the same period last year. It also anticipates a non-recurring profit-adjusted net profit of 295 million to 375 million yuan, an increase of 365.521 million to 445.521 million yuan compared to the same period last year.

In other news, according to China Fund News, Apple Inc. and U.S. rare earth company MP Materials announced on July 15 a $500 million agreement to procure rare earth magnets and jointly establish a rare earth recycling facility in California to strengthen the iPhone manufacturer’s U.S. supply chain.

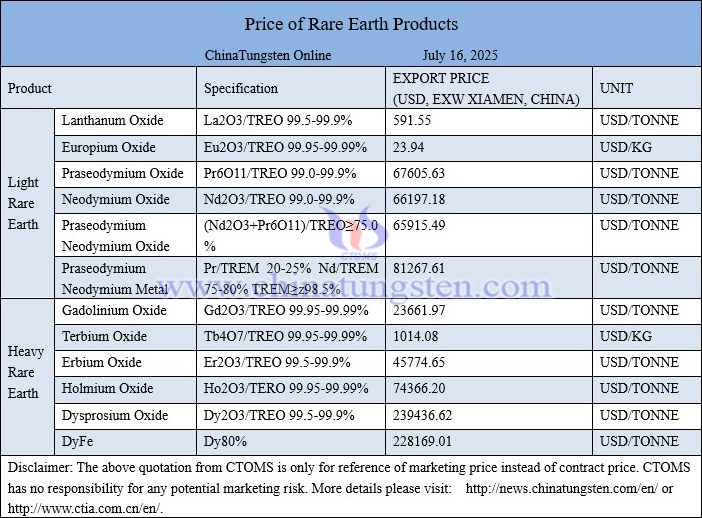

Price of rare earth products on July 16, 2025

Erbium oxide picture