In April 2025, the Chinese tungsten market exhibited an overall upward trend, with the increase in tungsten ore prices effectively transmitted to intermediate smelting products, which in turn led to a collective price hike in downstream hard alloy products. According to Chinatungsten Online, tungsten ore prices surged by over 6% during the month.

The primary drivers of the tungsten market's rise stem from the supply side: (1) The decline in ore grades and the normalization of environmental production restrictions have established a basis for tight tungsten ore resource supply; (2) The reduction in the first batch of mining quota control indicators this year has reinforced market expectations of tight supply; (3) Anticipation of supply tightening has attracted speculative capital into the market and intensified the reluctance of holders to sell. Additionally, domestic industry associations and leading enterprises have raised prices in response to market conditions, which has also bolstered market confidence to some extent during this period.

On the demand side, influenced by geopolitical factors and uncertainty in the global economic situation, the consumption of tungsten products has been lackluster, particularly with exports of low-to-mid-end alloys facing obstacles, resulting in insufficient overall market demand momentum. The recent rise in raw material prices has further dampened market purchasing sentiment, leading to sluggish spot transactions. In contrast, certain high-end tungsten products, such as high-performance hard alloy tools and special tungsten alloys used in aerospace and military applications, have maintained stable demand. Due to concerns over critical mineral security and the impact of international resource competition strategies, procurement deployments for tungsten resources in related fields have been further strengthened, providing the market with a degree of resilience.

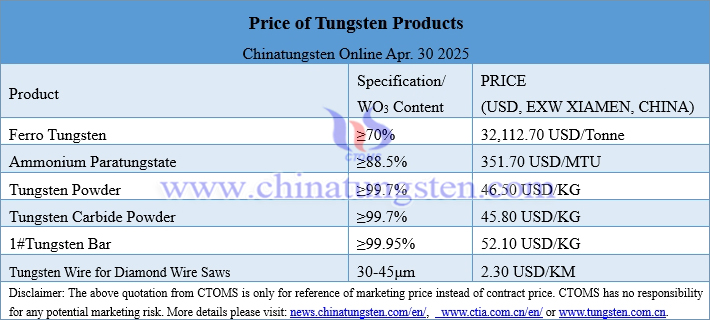

Prices of tungsten products on April 30, 2025

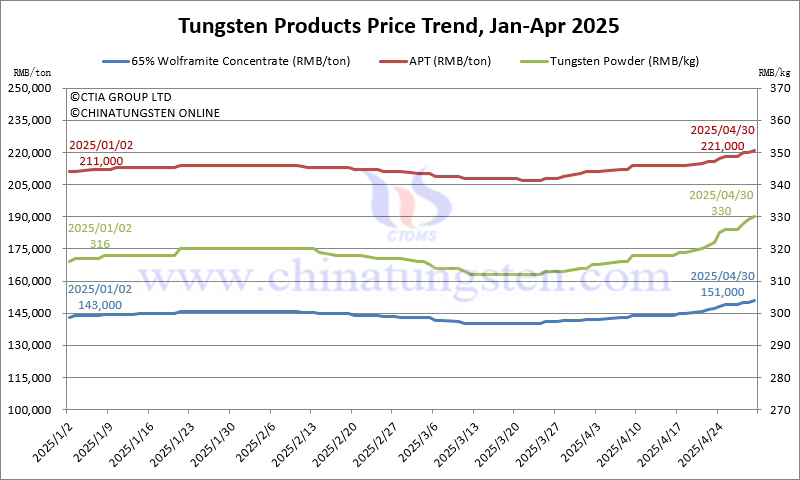

Price Trend of Tungsten Products in April 2025